What Does The Legal Debt Collection Process Involve?

The debt collection process in the UK contains several steps which can result in repayment of the debt at any point. If the debt is not repaid throughout any of the steps in the legal debt collection process, the final stage involves a County Court judgment and, subsequently a legal debt recovery process.

In this article, we will walk you through the multiple steps in the debt collection process according to UK law.

Contacting Legal Administration Services

Before beginning the steps in the debt collection process, the creditor must initiate the legal debt recovery process by contacting legal administration services that specialise in legal debt recovery. The creditor then provides proof of the debt, which can include the likes of invoices and recorded interactions, and any paperwork relating to the debt or proof of customer.

Sending A Letter Before Action To The Debtor

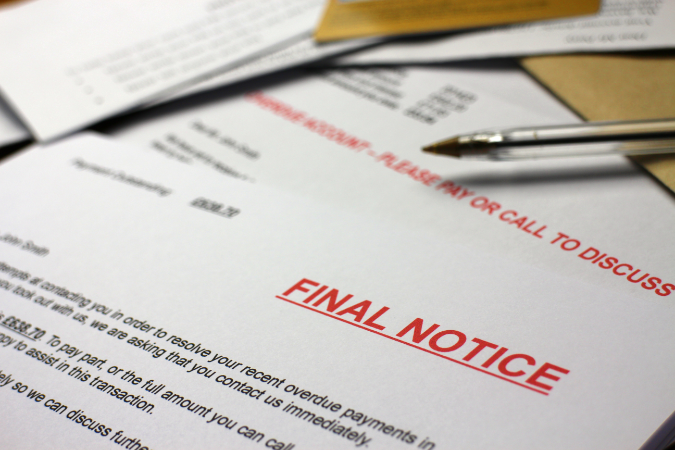

The first official step of the legal debt recovery process involves sending a Letter Before Action (LBA) to the debtor. The letter will be written, formatted, and sent by your chosen legal debt recovery administrators.

The letter will explain how much is owed, why it is owed, and to whom it is owed. It will also state the date by which the debt must be paid in full.

Taking Legal Action

If there is no response from the debtor within 14 days from the LBA, then your legal administrators write a letter to the court to make a claim for your debt.

In cases where the debtor intends to deny the debt and take the case to arbitration, then your legal debt recovery agency will be able to direct you to a solicitor if required to represent you. This is because while legal debt collection administrators can assist you during the court action, they cannot offer official legal advice.

County Court Judgement

The court will make its decision based on the available factors, and you win automatically if the debtor fails to show.

Enforcement of Debt Repayment

The final step is the legal enforcement of the debt repayment. Depending on the circumstances, you may instruct a Bailiff or High Court Enforcement Officer to either collect the debt or seize goods to cover the value of the debt.

Next Steps

Don't let debt hold you back any longer. Take action today, and let us help you recover the money you are owed. Call us today at 01733 229466.

Image Source: Canva